Twitter, Inc. operates as a platform for public self-expression and conversation in real time United States, Japan, and internationally. The company offers Twitter, a platform that allows users to consume, create, distribute, and discover content. It also provides promoted products and services, such as promoted tweets, promoted accounts, and promoted trends, which enable its advertisers to promote their brands, products, and services. Twitter, Inc. was founded in 2006 and is headquartered in San Francisco, California.

Millionacres Real Estate Winners is a premium stock picking service for your real estate investing success. You will receive clear, actionable investing ideas and recommendations from this stock advisor service along with specific guidance on getting started in today's market. Morningstar — This large investment research organization provides information on a variety of assets, including stocks, bonds, mutual funds, and ETFs. Morningstar offers many stock picks for its free users, but even more content for its Morningstar Premium members. When you sign up, you get access to in-depth research on hundreds of thousands of securities, as well as a list of the best stocks.

Unlike other stock-picking services, Morningstar doesn't give you a tailored list of stocks to add to your portfolio. Instead, it provides in-depth research on many stocks, as well as the tools to track your portfolio. After that, you'll pay $29.95 for a monthly subscription, $199 for an annual subscription, $349 for a two-year membership, and $449 for a three-year membership. Twitter, Inc. is a global platform for public self-expression and conversation in real time.

It provides a network that connects users to people, information, ideas, opinions and news. The company's services include live commentary, live connections and live conversations. Its application provides social networking services and micro-blogging services through mobile devices and the Internet. The company can also be used as a marketing tool for businesses.

Its products and services include Promoted Tweets, Promoted Accounts and Promoted Trends. Twitter was founded by Jack Dorsey, Christopher Isaac Stone, Noah E. Glass, Jeremy LaTrasse and Evan Williams on March 21, 2006 and is headquartered in San Francisco, CA. If these people, who spend their entire professional career in the stock market, can't beat the markets, why do you think you can do better?

I use techniques I learned, earning two finance degrees to decide if I should buy or sell shares. But even with my background, I still have some big losers in the portfolio. TheStreet offers specialized resources related to investing, personal finance, retirement, technology, and markets. Jim Cramer is sometimes considered to be synonymous with TheStreet. Cramer is a media personality and an expert on the stock market. He is also a former hedge fund manager, columnist, and the author of many books and articles.

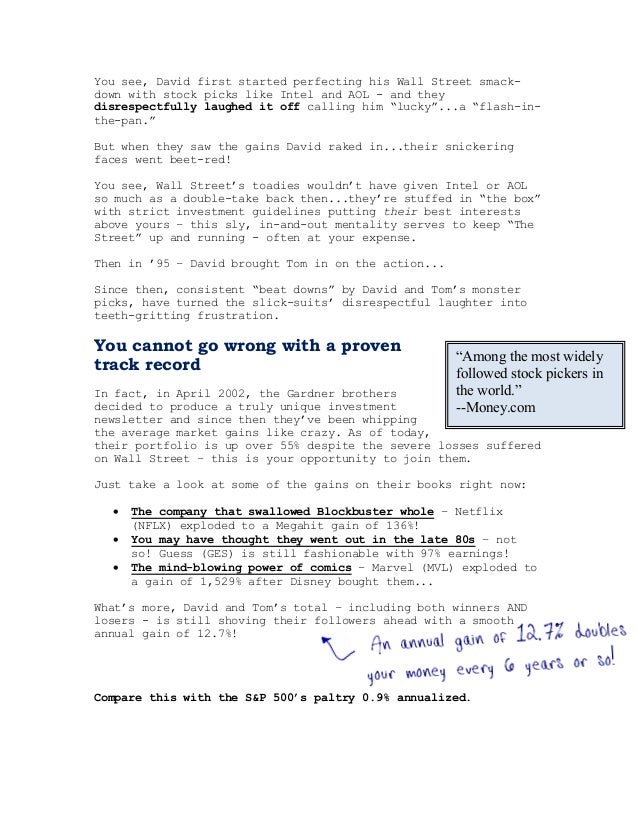

Seeking Alpha — This mega investing site includes a vast array of articles. The analysis here includes detailed stock market reporting and tips on why specific stocks look good right now. You can also read about the investment strategy and market news. Read a comparison we've made between Seeking Alpha and another market leader, The Motley Fool. Motley Fool — Founded in 1993, The Motley Fool is an investment education website that provides a variety of free and paid content.

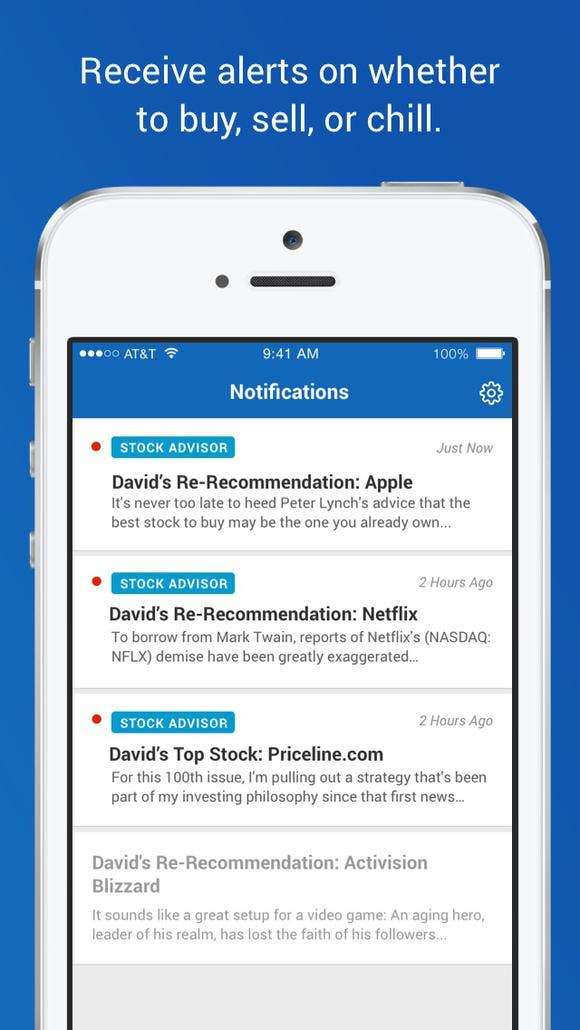

Its primary service is the Motley Fool Stock Advisor, which provides stock picks. According to the company's website, Stock Advisor has 4X'ed the S&P 500 over the past two decades. When you sign up, you'll get two stock recommendations per month, ongoing sell notices, and monthly Best Buys Now.

Motley Fool's Stock Advisor has a price tag of $39 per month or $99 per year. Some popular paid programs include Dow Theory, Jason Bond Picks, and Jim Cramer's Action Alerts Plus from The Street. These services all employ human investment professionals who analyze and report to members which stocks they recommend. Fake news is considered one of the main threats to the global information revolution in the world.

They tend to cause serious damages to the reputation of persons or organizations, they also tend to cause many indirect effects on other aspects depending on the type of fake news. Fake financial news represents one of the serious types of fake news; its effects can cause direct and serious damages to the stock market. In this work, we present five models to detect fake financial news using sentiment analysis, news sources checking, objectivity check, checking against existing news, and a fact-checking method. Datasets have been created especially for this project in addition to the online available data sources. The sentiment analysis model has been done using the deep learning model in and it has achieved 87% accuracy, while the objectivity check has not achieved significant results. News sources analysis problem has been dealt with as a traditional term frequency problem, the solution achieved a 94% accuracy value.

Due to the lack of enough data sources, the fact-checking solution has ended up in creating a dataset that is ready for fact-checking against any relational dataset of periodic values such as the stock market. Finally, the similarity check against existing news has achieved a 76% accuracy value. Investors that covers topics such as stock picks, stock analysis, investment opportunities, options trading and VectorVest's rules-based investment strategies. This blog can help you gain insights and experience needed to manage your portfolio in today's stock market. KINFO — Join KINFO and connect your existing brokerage account to get started with this free stock picking app.

Once you log in, you can compare your portfolio to those of professional investors and hedge funds and get other details on stocks you own and ones you are interested in. You can also browse other user portfolios, including some well-known personal finance bloggers. These are two of many financial websites, and they offer a comprehensive suite of products and information. The Motley Fool is a private financial and investing advice company that is based in Alexandria, Virginia. It employs analysts and experts across the country who are constantly combing the market for the best stock picks and investment ideas. The name the Motley Fool comes from the Shakespeare comedy As You Like It.

The play references only one character that can speak the truth to the Duke without having his head lopped off—the court jester. He provides his Tim Alerts daily newsletters with penny stock picks every market day around 8am EST / 5am PDT with a set of stock watchlists for the day. You can receive this by email, SMS or even push notifications in real time throughout the trading day. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more.

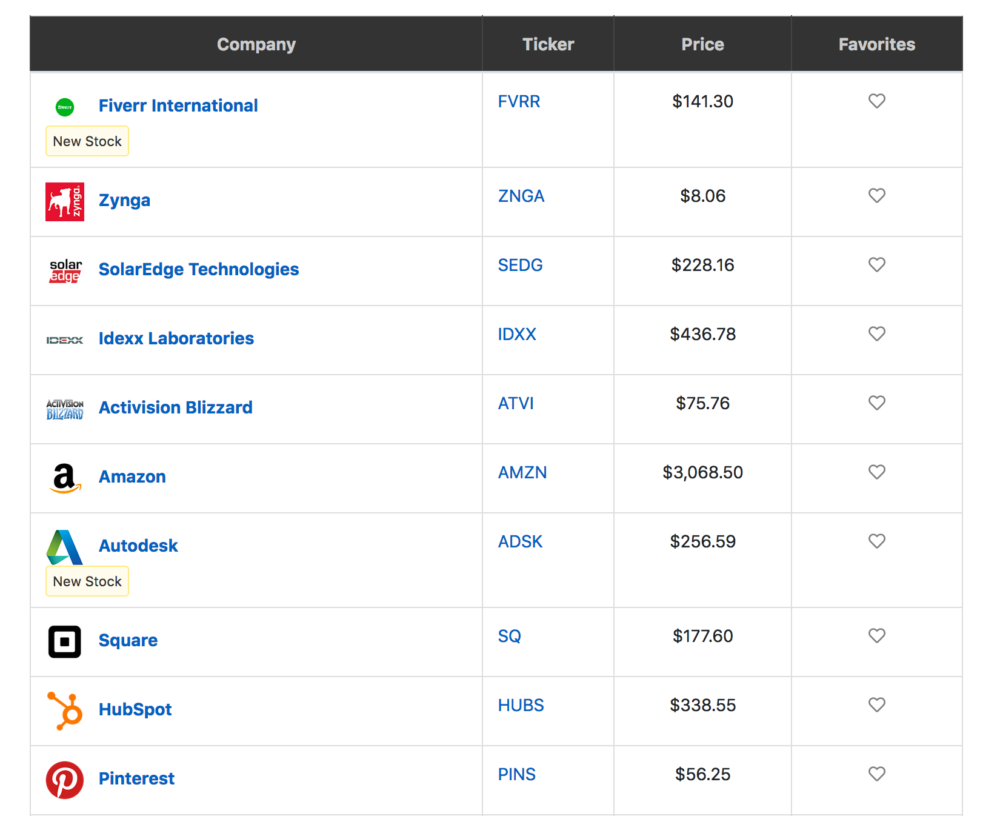

It is worth noting that many of these stocks have already been recommended in the firm's other, more basic investment services. Prior research has examined how companies exploit Twitter in communicating with investors, and whether Twitter activity predicts the stock market as a whole. We test whether opinions of individuals tweeted just prior to a firm's earnings announcement predict its earnings and announcement returns.

Using a broad sample from 2009 to 2012, we find that the aggregate opinion from individual tweets successfully predicts a firm's forthcoming quarterly earnings and announcement returns. These results hold for tweets that convey original information, as well as tweets that disseminate existing information, and are stronger for tweets providing information directly related to firm fundamentals and stock trading. Importantly, our results hold even after controlling for concurrent information or opinion from traditional media sources, and are stronger for firms in weaker information environments. Our findings highlight the importance of considering the aggregate opinion from individual tweets when assessing a stock's future prospects and value. We know relatively little about how real world emotions affect real world settings, like financial markets. Here, we demonstrate that estimating emotions from weblogs provides novel information about future stock market prices.

That is, it provides information not already apparent from market data. Specifically, we estimate anxiety, worry and fear from a dataset of over 20 million posts made on the site LiveJournal. Using a Granger-causal framework, we find that increases in expressions of anxiety, evidenced by computationally-identified linguistic features, predict downward pressure on the S&P 500 index. We also present a confirmation of this result via Monte Carlo simulation. The findings show how the mood of millions in a large online community, even one that primarily discusses daily life, can anticipate changes in a seemingly unrelated system.

Beyond this, the results suggest new ways to gauge public opinion and predict its impact. Tracking the spread of an epidemic disease like seasonal or pandemic influenza is an important task that can reduce its impact and help authorities plan their response. In particular, early detection and geolocation of an outbreak are important aspects of this monitoring activity. Various methods are routinely employed for this monitoring, such as counting the consultation rates of general practitioners. We report on a monitoring tool to measure the prevalence of disease in a population by analysing the contents of social networking tools, such as Twitter. Our method is based on the analysis of hundreds of thousands of tweets per day, searching for symptom-related statements, and turning statistical information into a flu-score.

We have tested it in the United Kingdom for 24 weeks during the H1N1 flu pandemic. We compare our flu-score with data from the Health Protection Agency, obtaining on average a statistically significant linear correlation which is greater than 95%. This method uses completely independent data to that commonly used for these purposes, and can be used at close time intervals, hence providing inexpensive and timely information about the state of an epidemic. Market liquidity has an immediate impact on the execution of transactions in financial markets.

Informed counterparty risk is often priced into market liquidity. This study investigates whether microblogging data, as a non-financial information tool, is priced along with market liquidity dimensions. The analysis is based on the Australian Securities Exchange , and from the results, we conclude that microblogging content in pessimistic periods has a higher impact on liquidity and its dimensions. On a daily basis, pessimistic investor sentiments lead to higher trading costs, illiquidity, a larger price dispersion and a lower trading volume. This paper describes early work trying to predict stock market indicators such as Dow Jones, NASDAQ and S&P 500 by analyzing Twitter posts. We collected the twitter feeds for six months and got a randomized subsample of about one hundredth of the full volume of all tweets.

We measured collective hope and fear on each day and analyzed the correlation between these indices and the stock market indicators. We found that emotional tweet percentage significantly negatively correlated with Dow Jones, NASDAQ and S&P 500, but displayed significant positive correlation to VIX. It therefore seems that just checking on twitter for emotional outbursts of any kind gives a predictor of how the stock market will be doing the next day.

I think my advice is just use stock advisor as a data input, a signal in your overall investing strategy. Don't rely on it with blind faith AS an investment strategy in itself. That's a pittance compared to the fees you'll pay as an investor over the years and the ups and downs in your portfolio. Though, for these prices, you get access to what is likely the best day trading stock picking service on the market.

If you've got a lot of capital you plan to place at risk, this investment is a no brainer. While Twitter's revenue growth will likely accelerate in Q2, the company's user growth may slow. Though the social network has an easy revenue comparison, it has a tough user growth comparison. As consumers looked for ways to stay entertained at home during the second quarter of 2020, Twitter's monetizable daily active users soared 34% year over year. This was followed by 27% and 20% year-over-year growth in these daily users in the fourth quarter of 2020 and the first quarter of 2021, respectively.

Survey-based consumer confidence indicators are mostly reported with a delay and are a result of time consuming and expensive consumer surveys. In this study, to measure the current consumer confidence in Germany, we develop an approach, in which we compute the consumer sentiment using public Tweets from Germany. To measure the consumer sentiment, we use text-mining tools and public Tweets from May 2019 to August 2020.

Our findings indicate that there is a high correlation between the consumer confidence indicator based on survey data, and the consumer sentiment that we compute using data from Twitter platform. With our approach, we are even able to forecast the change in next month's consumer confidence. The best stock picking service for you will depend on whether you're a day trader or long-term investor, your level of trading expertise, and your budget for services. He's created a stock picking service in addition to finance services, educational content and training to retail investors.

Motley Fool Rule Breakers is an investment advisory service which provides insight and recommendations on market-beating growth stocks and businesses which are poised to be tomorrow's stock market leaders. 3 Tiny Stocks Primed to Explode The world's greatest investor — Warren Buffett — has a simple formula for making big money in the markets. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential. The 2015 film 'The Big Short' investor had deleted his Twitter account in early April after flagging the Tesla stock, which he is short along with GameStop, bitcoin, dogecoin, Robinhood, SPACs, inflation, and the broader stock market. American investor Michael Burry, who shot to fame in the global financial crisis of a decade-and-a-half ago, on June 15 warned of the "greatest speculative bubble" in the history of stock markets. Perhaps those who were clambering all over this as a oft-repeated recommendation of the Motley Fool thought that TTD had somehow magically become the only ad-tech company around, or was going to get a pass on taking over the world.

When a stock doubles in a couple months, you attract investors who are expecting dramatic things every time a new quarter is released, and this quarter, while very good, was not at dramatic in the context of TTD's past performance. Mindful Trader is a data-driven stock picking service and trading strategy platform that allows regular investors to follow — and mimic — the market-beating moves of Eric, its numbers-whiz founder. Their screener allows you to quickly sift through US-based stocks using an array of fundamental metrics. One included metric is book value per share, a favorite metric Warren Buffett uses to value companies for Berkshire Hathaway. A paid subscription adds a few features, but the free version is a top stock market screening tool. The stock lost about 10% even as the S&P 500 rose by more than 1% over the period.

This reflects a largely challenging period for growth tech stocks like Twitter, many of which are underperforming the market recently. We introduce a novel set of social network analysis based algorithms for mining the Web, blogs, and online forums to identify trends and find the people launching these new trends. These algorithms have been implemented in Condor, a software system for predictive search and analysis of the Web and especially social networks. The temporal calculation of betweenness of concepts permits to extract and predict long-term trends on the popularity of relevant concepts such as brands, movies, and politicians.

We illustrate our approach by qualitatively comparing Web buzz and our Web betweenness for the 2008 US presidential elections, as well as correlating the Web buzz index with share prices. So I signed up for stock advisor since Amex has an offer where you get the yearly fee back as an account credit. Immediately on logging in, the very first thing it shows me is a page trying to upsell me to a service called Rule Breakers that costs 4 times as much. Seems like a massive red flag and dirty tactic since all the marketing before signing up focused on Stock Advisor. As to the stock picks themselves, it shows a very small handful of picks some of which seem pretty strange. By using a free paper trading service, you can test the recommendations of the stock picking service and how they perform relative to the market.

You can use this paid swing trading stock picking service to take advantage of short-term movements in the market. The powerful service allows you to access real-time streaming trading ideas on simultaneous charts to learn how to trade into risk-reward balanced trades. You can use these trade ideas proposed in real-time through a live simulated trading room. This allows you to demo the stock picking service's ideas without risking your own money.

Trade Ideas employs an artificial intelligence-powered assistant named Holly. This AI becomes your virtual research analyst who never sleeps and instead sifts through technicals, fundamentals, social media, earnings and more to pick stocks as real-time trade recommendations. Using these services doesn't mean you're off the hook for doing any of your own due diligence, but they can save you a lot of time.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.